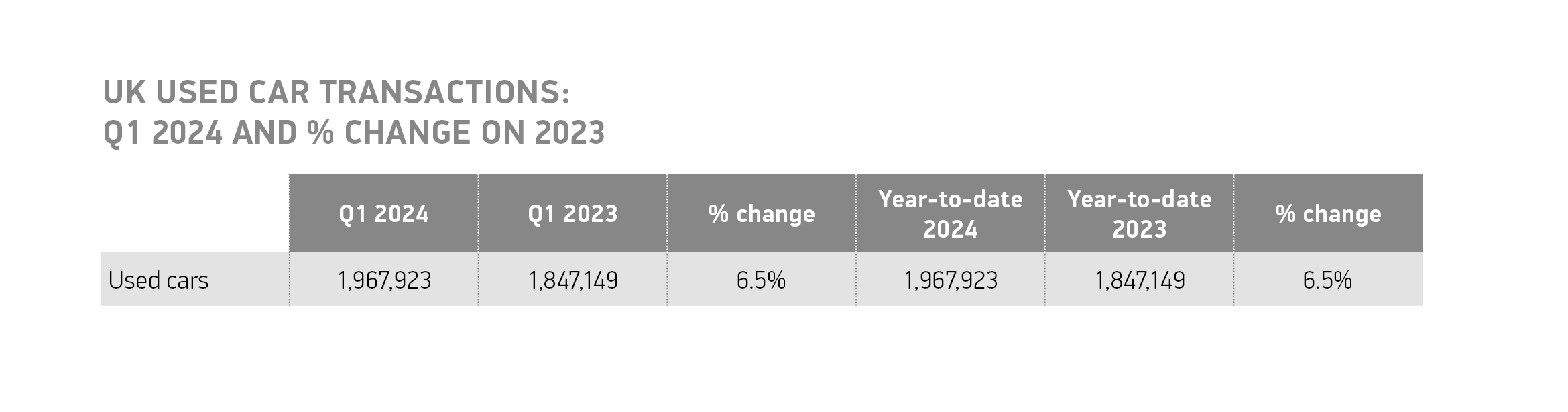

THE UK’s used car market rose by 6.5% in the first quarter of 2024 with 1,967,923 units finding new owners – the strongest start to a year since pre-pandemic 2019, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT).

The increase marks 16 months of successive growth, reflecting recovering supply in the new car market which is in turn improving availability and choice of second-hand motors. Used car transactions have risen in every month of the year to date1 but, despite this robust growth, the quarter’s transactions remain 2.6% below pre-Covid levels.

Increasing numbers of battery electric vehicles (BEVs) are now entering the used sector, with Q1 sales up by more than two thirds (71.0%) to 41,505 – posting a new record market share of 2.1%. This makes BEVs the fastest growing powertrain as more buyers are attracted to the potential cost-saving and environmental benefits. Hybrids (HEVs) also continued to sell in greater volumes, with 74,502 changing hands in a 49.3% rise. Plug-in hybrids (PHEVs), too, grew in popularity, with sales up 42.5% to 22,065.

Conventional powertrains remained dominant in the quarter, with sales of petrol cars rising 7.7% to 1,130,396, while those of diesels fell by 1.3% to 697,718. Combined, these cars accounted for 92.9% of all transactions (1,828,114 units) with market share shrinking by just over two percentage points on Q1 2023 as more buyers move to electrified vehicles.

Superminis remained the most popular vehicle type, with 640,711 changing hands – a 7.2% increase. In second place, the lower medium segment grew by 9.2% and saw the biggest volume gain at 45,301 units. Rounding off the top three, which remains unchanged on the same period in 2023, dual purpose represented 16.0% of the market and recorded the best percentage growth with a 10.3% rise. Together, these segments accounted for three quarters of all cars sold in the period. At the other end of the scale, executive, luxury saloon and upper medium were the only segments to record declines, down 3.5%, -2.0% and 0.5% respectively.

The top three colours were unchanged from Q1 2023, with black taking pole position for the 13th quarter and equating to 21.3% of sales. Grey, the most popular new car colour, held second place but recorded the biggest growth in the top 10, up 10.7%, and blue retained third, with a 6.2% uplift in transactions. Gold and cream were the only colours in the top 20 to decline, falling by 2.5% and 0.6% respectively.

Mike Hawes, SMMT Chief Executive, said: A reinvigorated new car market is delivering more choice and affordability for used car buyers and, increasingly, they are choosing to go electric. To enable even more drivers to enjoy the benefits of zero emission motoring, ensuring both supply and demand remains robust is essential. Incentivising new EV uptake and investing in a chargepoint network that is accessible, available and affordable to all will drive the nation’s net zero transition.”

James Hosking, Managing Director of AA Cars noted that at a time when household budgets remain stretched, drivers opting for a used car will find they can get very good value. The latest AA Cars Used Car Index showed that the average prices of the UK’s most sought-after used cars fell by 9% during the first three months of 2024 compared to the same period last year.

“While these price falls represent a relatively gentle reset compared to the big increases seen immediately following the pandemic, prices of EVs and hybrids are falling significantly. Consistently cheaper prices for EVs and hybrids could convince drivers who have yet to try an electric car to take the plunge.

“This could in turn help second-hand EV sales reach record levels this year, and while they still make up just a small percentage of the overall market, the move to EVs is now well underway. “Education about batteries, range and charging remains key, and dealers have a big role to play in advising consumers about the difference between electric cars and their petrol and diesel counterparts.”

Leave A Comment