DEMAND for used battery electric (BEV) and plug-in hybrid (PHEV) vehicles continued to grow in Q3, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).

Reflecting recent trends in both the new and used markets, transactions rose by 56.4% and 43.3% to 14,182 and 14,990 respectively. Indeed, the number of used BEVs that changed hands during the period was the highest recorded in any quarter. Hybrid electric vehicle (HEV) transactions also increased by 20.3% to 40,157.

Thanks to an ever-growing choice of new zero emission models coming on sale, for both new and used car buyers, the market share for all used plug-in vehicles increased to 1.4%, up from 0.9% the previous year. Petrol and diesel powertrains continued to dominate, however, comprising 96.4% of all transactions equivalent to 1,959,955 units, although demand for both declined, by 6.9% and 7.6% respectively.

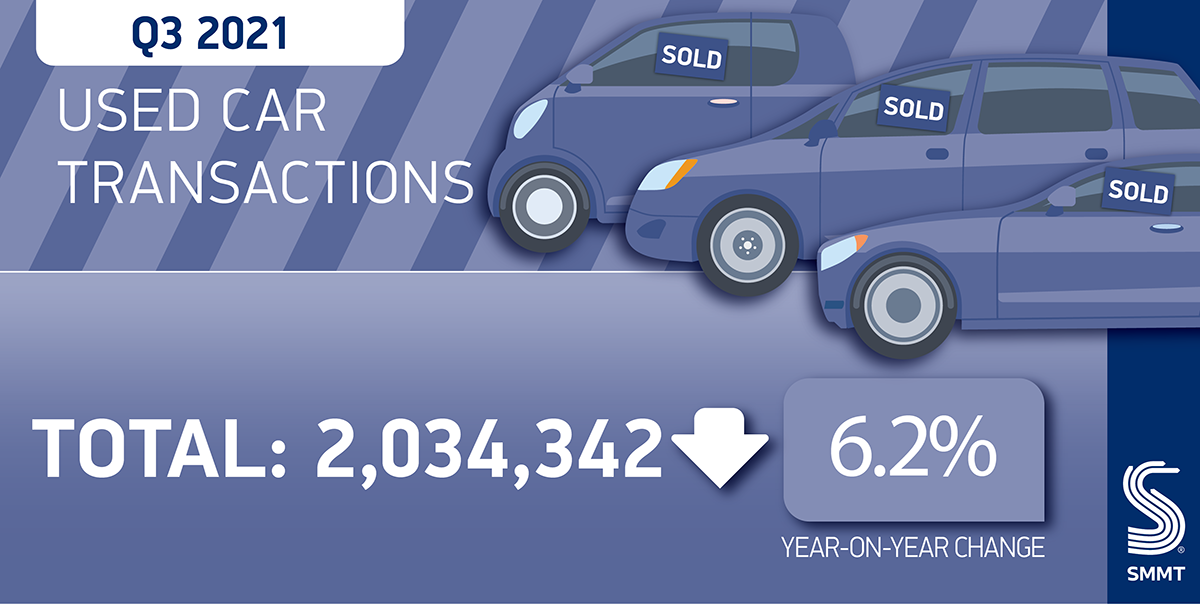

This strong plug-in performance comes despite the UK’s used car market falling -6.2% in the third quarter of 2021. 2,034,342 vehicles changed hands, 134,257 less than in Q3 2020 when the re-opening of showrooms and easing of lockdown measures saw the market bounce back strongly.

Used car transactions declined in every month across the quarter, with July, August and September all falling, by 4.9%, 5.9% and 7.9% respectively.1 Overall, the period is down 2.0% on 2019 pre-pandemic, making it the weakest quarter three since 2015.2

Mike Hawes, SMMT Chief Executive, said: “Despite the used car market declining in the third quarter, record sales earlier in the year, particularly in the second quarter, means the market remains up year to date. Given the circumstances, with the global pandemic causing a shortage of semiconductors needed to produce new vehicles, undermining the new car market, used transactions were always going to suffer too.

“This is particularly worrying as fleet renewal – of both new and used – is essential if we are to address air quality and carbon emissions concerns.”

James Fairclough, Chief Executive of AA Cars, said that after a record-breaking second quarter, the used car market couldn’t sustain the momentum into the third quarter of 2021.

He added: “While the used market is not affected directly by the semiconductor shortage that is constraining the production of new cars, the supply of second-hand cars can only be so elastic.

“Despite strong demand from buyers, finite supply is pegging back used car sales figures – albeit to a lesser extent than the decline seen in new car sales.

“With car factories in the UK and elsewhere churning out fewer vehicles than usual, the second-hand market’s trump card is availability – especially of hugely popular electric and plug-in hybrid models.

“On the AA Cars website we’ve seen a surge of interest in used vehicles that are available to drive away today.

“That spike in buyer interest is steadily pushing up used car values too. The average prices of the 30 most popular used vehicles for sale on AA Cars have risen 57% during the past two years. Demand for some models is so strong that they are even appreciating with age.

“While there are some great deals to be had on used cars, we always recommend that an independent pre-sale vehicle inspection takes place on any second-hand car before any money changes hands, to ensure drivers can have peace of mind that there are no hidden faults which could cost them money down the line.”

Leave A Comment