A SMALL boost for the new car market in February which showed some marginal growth during the month, up 1.4% following five straight months of decline,.

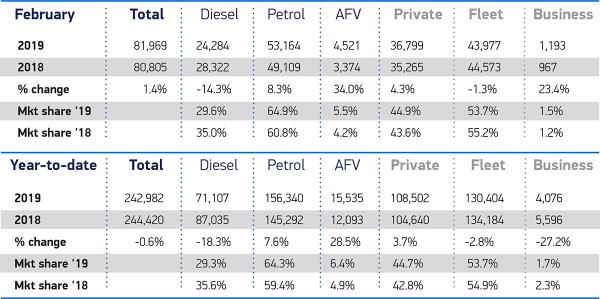

According to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). 81,969 new cars were registered on UK roads in the month (a year on year uplift of 1,164 units), traditionally one of the quietest of the year, ahead of the crucial March plate change.

Demand for alternatively fuelled vehicles continued to surge, up 34.0% and marking the 22nd consecutive month of growth for the segment as new and existing cutting-edge models attracted buyers into showrooms.

Registrations of zero-emission electric cars enjoyed particular growth, more than doubling to 731 units, although they still accounted for less than 1% of the market (0.9%).

Meanwhile, in the four months since the October 2018 reform to the Plug-in Car Grant, the market for plug-in hybrid electric vehicles (PHEVs) has only grown by 1.7%, compared with 29.5% over the first 10 months of 2018.1 This suggests that removing the incentive for PHEVs is having an adverse effect.

Mike Hawes, SMMT Chief Executive, said, “It’s encouraging to see market growth in February, albeit marginal, especially for electrified models. Car makers have made huge commitments to bring to market an ever-increasing range of exciting zero and ultra low emission vehicles and give buyers greater choice.”

He added that the recent removal of the plug-in car grant from plug-in hybrids was a backward step and sends entirely the wrong message. “Supportive, not punitive measures are needed, else ambitions will never be realised.”

Leave A Comment