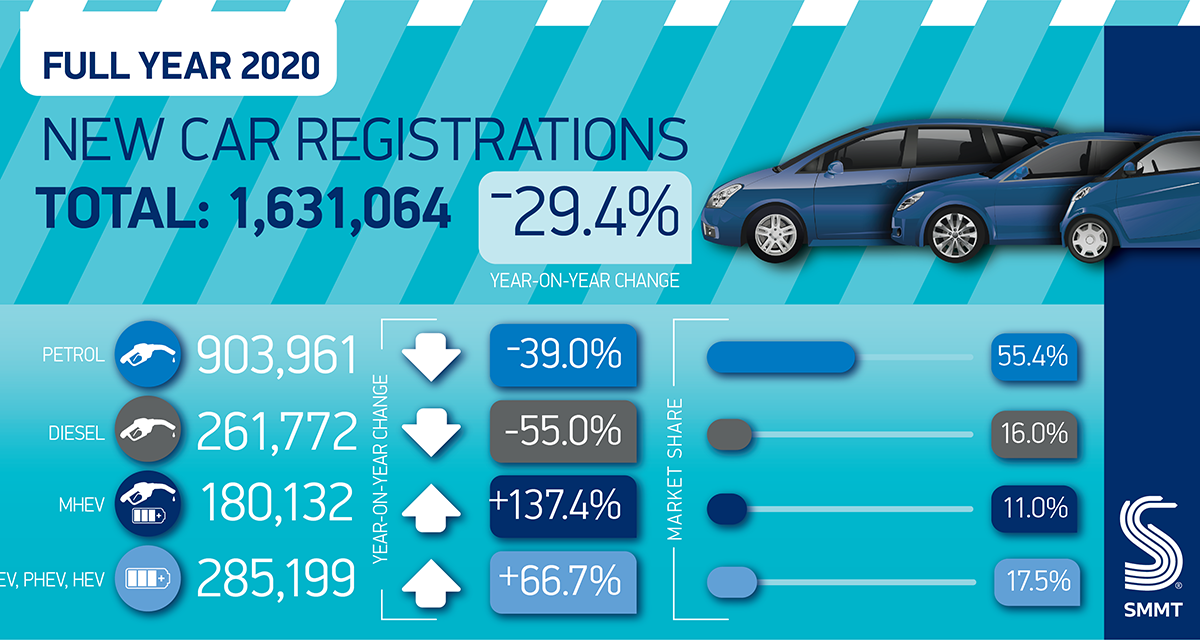

NO REAL surprise that UK new car market fell by almost a third in 2020, with annual registrations dropping to 1,631,064 units, according to figures published by the Society of Motor Manufacturers and Traders (SMMT).

A 10.9% decline in December wrapped up a turbulent 12 months, which saw demand fall by 680,076 units to the lowest level of registrations since 1992.

Against a backdrop of Covid restrictions, an acceleration of the end of sale date for petrol and diesel cars to 2030 and Brexit uncertainty, the industry suffered a total turnover loss of some £20.4 billion. Private vehicle demand fell by -26.6% overall, amounting to a £1.9 billion loss of VAT to the Exchequer. The year saw also saw -31.1% fewer vehicles joining large company car fleets.

In an atypical year, demand fell across all segments bar specialist sports, which grew by 7.0%, although Britain’s most popular class of car remained the supermini, retaining a 31.2% market share despite a -25.9% decline in registrations. Meanwhile, although falling by a combined -32.9%, petrol and mild hybrid (MHEV) petrol cars made up 62.7% of registrations, while diesel and MHEV diesels, down -47.6%, comprised almost a fifth (19.8%) of the market.

It was, however, a bumper year for battery and plug-in hybrid electric cars, which together accounted for more than one in 10 registrations – up from around one in 30 in 2019. Demand for battery electric vehicles (BEVs) grew by 185.9% to 108,205 units, while registrations of plug-in hybrids (PHEVs) rose 91.2% to 66,877.

Encouragingly, there is room for further growth as most of these registrations (68%) were for company cars, indicating that private buyers need stronger incentives to make the switch, as well as more investment in charging infrastructure, especially public on-street charging.

More than 100 plug-in car models are now available to UK buyers, and manufacturers are scheduled to bring more than 35 to market in 2021 – more than the number of either petrol or diesel new models planned for the year. To increase uptake will require others to match the industry’s commitment to electrification and SMMT will continue to work with government on the detail of a strategy to deliver a successful, rapid transition that benefits all of society and safeguards automotive manufacturing with sufficient battery production capacity.

Looking ahead, the SMMT said another lockdown across England and ongoing tough restrictions across the rest of the UK will further impact the industry and, while click and collect can continue to provide a lifeline, it cannot offset the impact of showroom closures. With a vaccine programme now underway, however, in 2021 there is the potential to drive a recovery that would also support the UK’s environmental goals.

Additionally, with the UK-EU Trade and Cooperation Agreement now in force, the industry has avoided a catastrophic ‘no deal’ scenario and can plan for a future with more certainty over trading conditions. Given seven out of 10 new cars registered in the UK in 2020 were imported from Europe, the continuation of tariff- and quota-free trade is critical to a strong new car market in the UK.

Sue Robinson, Chief Executive of the National Franchised Dealers Association said that is was encouraging that despite the issues affecting the automotive industry and the economy, the EV market continued to grow, showing an increase in consumer appetite and rewarding the efforts dealers are making to meet the demand.

She added: “Although physical showrooms must remain closed over the coming weeks, franchised dealers have demonstrated their ability to adapt, providing ‘click and collect’ services to customers in a safe and compliant manner. This cannot fully replace the traditional buying experience but will offset some of the issues facing businesses over the coming months.

“Overall, 2020 was a difficult year and the recently announced third national lockdown will be challenging for franchised retailers. However, in the longer term the signing of an agreement with the EU, the shift to EVs and the resilient nature of franchised dealers mean they are well placed for growth”.

Ian Plummer, Auto Trader’s Commercial Director, pointed to the increase in EV sales as a bight spot. “With consumer interest in greener technologies increasing, coupled with a plethora of new models now available, the green transition has certainly begun.

“If we were to see this continued level of uptake in EVs then we anticipate that sales of new EVs and plug in hybrids will overtake diesel cars in 2021, and then pure EVs will overtake those of their internal combustion engine counterparts in 2026.

“The industry, with everything that it has had to deal with in the year, has also responded and adapted remarkably quickly. We’ve seen retailers and manufacturers begin to shift their selling methods, with many launching new online elements of the car buying journey, enabling them to operate within the confines of click and collect and home delivery.

“Being able to buy a car fully online or at least do more elements of the journey online was always coming, but the pandemic and the restrictions that its brought have only accelerated both the technology required to fulfil these services and consumer adoption of these services. This is a trend that’s set to continue into this year.

“As we look ahead to 2021, notwithstanding negative dents to sales from the current and any further national lockdowns, data suggests that sales will bounce back to c.2 million levels. Although not as high as we saw in 2019, we certainly aren’t expecting levels to dip down to what we saw during the global financial crisis.

“Consumer confidence levels, historically the key driver of the new car market, remain relatively strong as does the availability of good credit options, which bode well for the new car market.”

Auto Trader has announced support for all UK retailer partners following the latest lockdown restrictions by providing its advertising packages for free for the month of February and an extension to its payment terms by 30 days for its January services.

This follows the Governments’ announcement on 4 January to increase the level of COVID-19 restrictions across the UK, which has once again forced all car retailers to close their showrooms. This support will help to ease retailers’ cash flow and enable them to come back quickly as soon as the restrictions are eased.

Nathan Coe, Chief Executive Officer of Auto Trader, said: “We had all hoped that by now, with news of vaccines, that there would be a clear end in sight and that we could put this incredibly challenging period we’ve all experienced behind us. But once again, we face new challenges and further lockdown restrictions – certainly not the start to 2021 we were all hoping for.”

Leave A Comment