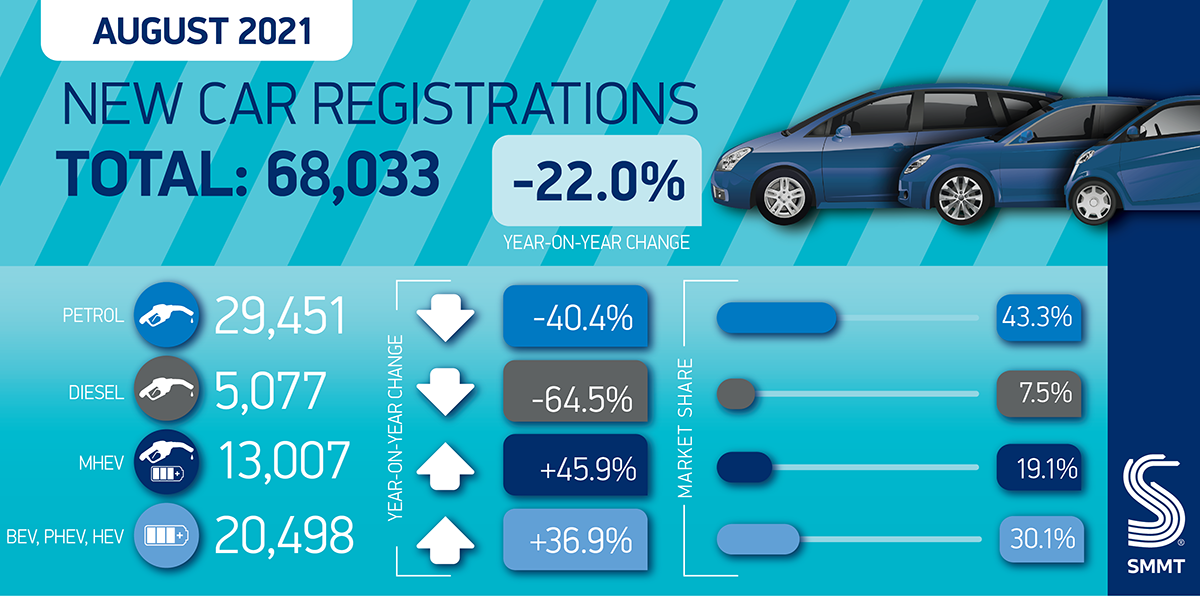

AUGUST is traditionally a poor selling month for new cars, ahead of the September plate change, but even so, new car registrations fell 22.0% last month.

According to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). 68,033 units were registered, the weakest since August 2013, and down 7.6% against the average recorded over the last decade, due in part to constrained supply as the global shortage of semiconductors, an issue born of the pandemic, continues to undermine production volumes.

Demand for the latest battery electric (BEV), hybrid (HEV) and plug-in hybrid (PHEV) vehicles, however, surged, up 32.2%, 45.7% and 72.1% respectively. In fact, demand for PHEVs has outpaced BEVs in five of the last six months since changes to the Plug-in Car Grant, affecting BEVs, were introduced in March. There are now some 130 plug-in models on the market, with the range ever-increasing.

Registrations by private, business and fleet buyers all fell by double digits in the month with fleet purchases down 27.5%, a loss of 12,627 units. Private activity held up better, registrations dropping 15.2% to 33,771 units, meaning that just shy of half (49.6%) of all sales in August were driven by private consumers. The mini segment was the only car bodystyle to see growth, up 30.7%, but with just 902 registrations it is a segment prone to greater fluctuations.

So far this year, UK new car registrations remain up 20.3%, to 1,101,302 registrations, an increase of 185,687 units with BEVs and PHEVs at 8.4% and 6.6% market share respectively. However, this performance is measured against the Covid-hit 2020 market, when showrooms were closed for much of the year. Total registrations in 2021 are -25.3% below the 10 year average for the period January – August, illustrating the ongoing and wide ranging impact of the pandemic on automotive retail.

Mike Hawes, SMMT Chief Executive, said: “While August is normally one of the quietest months for UK new car registrations these figures are still disappointing, albeit not wholly surprising. The global shortage of semiconductors has affected UK, and indeed global, car production volumes so new car registrations will inevitably be undermined.

“Government can help by continuing the supportive Covid measures in place currently, especially the furlough scheme which has proven invaluable to so many businesses.As we enter the important September plate-change month with an ever-increasing range of electrified models and attractive deals, buyers in the market for the new 71 plate can be reassured manufacturers are doing all they can to ensure prompt deliveries.”

Sue Robinson, Chief Executive of the National Franchised Dealers Association (NFDA), added: “It is encouraging to see that strong sales of electrified vehicles partly offset the monthly decline. Year to date, the market is 20% above last year, although the overall performance is not yet at pre-pandemic levels.

“Despite the decrease in new car registrations, franchised vehicle dealers are optimistic about their prospects for the remainder of the year as consumer confidence remains robust, as demonstrated by buoyant sales of used and nearly new cars.”

James Fairclough, Chief Executive of AA Cars pointed to a silver lining to the clouds currently hanging over the market. He added: “The culprit is likely to be patchy supply rather than flagging demand.

“In July the number of cars leaving UK factories and heading for the domestic market slumped by 38.7%, meaning that despite dealers’ best efforts to fulfill orders as quickly as possible, too often they just don’t have the vehicles to sell.

“While this is as frustrating for dealers as it is for motorists, the supply issues are expected to be temporary. Meanwhile customer demand for cars remains robust, especially for electric and hybrid vehicles of all kinds, which together are now outselling conventional petrol and diesel models.

“Sales of plug-in hybrids in particular are soaring, and in August they were up 72.1% on the same month in 2020. With both the economy and consumer confidence recovering well, motorists are steadily returning to forecourts – and last week’s arrival of the new registration plates should give the market an additional lift in September.

“But the mismatch between customer demand and the constrained supply of new cars for sale means much of the action has shifted to the second-hand market, where buyers can traditionally get a nearly-new car for significantly less money than a new one.

“On the front-line we’re seeing the used market perform very well, but we always recommend that an independent pre-sale vehicle inspection takes place on any second-hand car before any money changes hands, to ensure drivers can have peace of mind that there are no hidden faults which will cost them money down the line.”

Leave A Comment