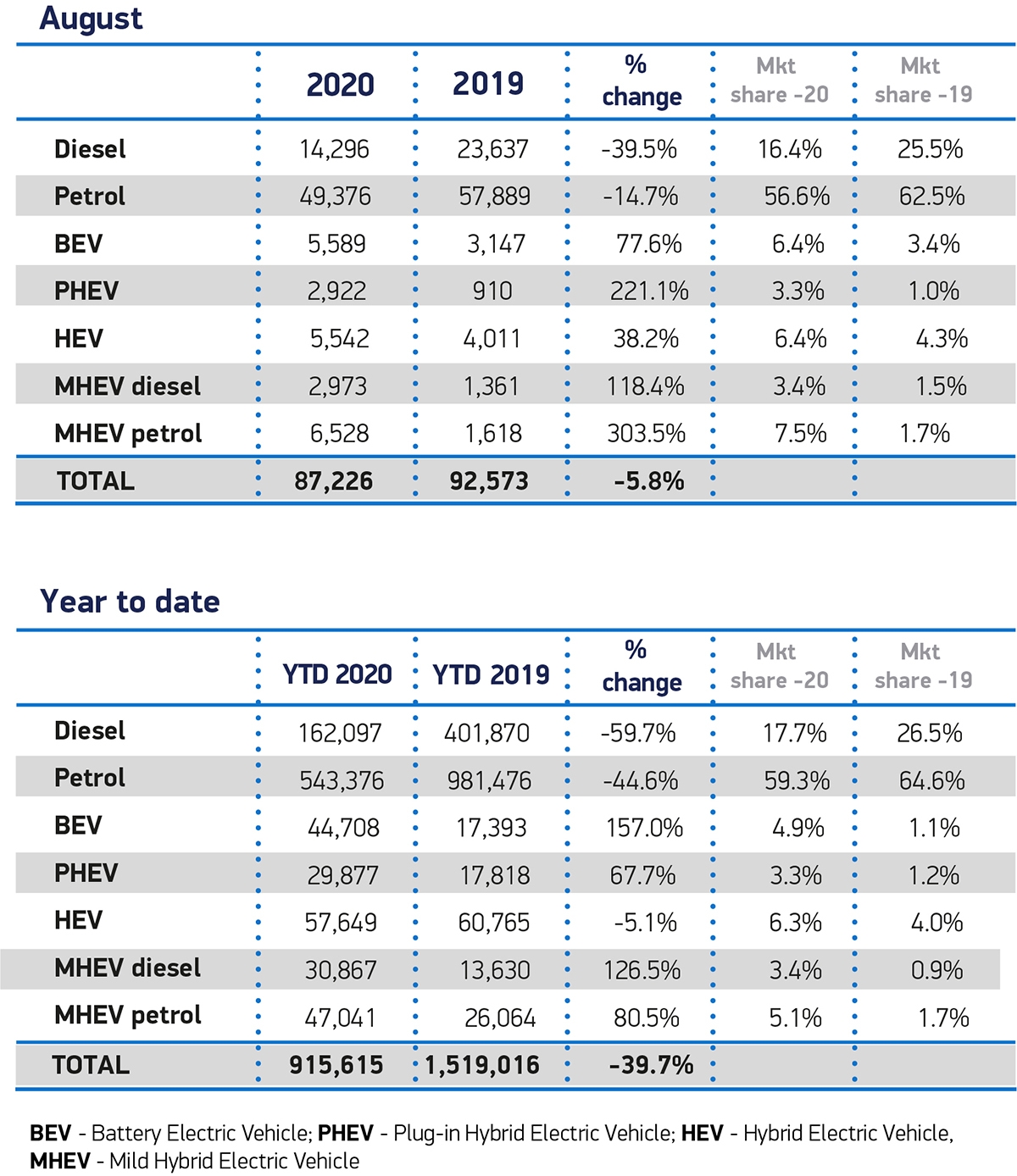

NEW car registrations declined fell 5.8% in August, according to the latest SMMT figures with just over 87,000 vehicles registered during what is traditionally the quietest month of the year.

While registrations to private buyers held relatively steady, down by 699 units in the month, demand from businesses of all sizes was much more subdued, with 2,650 fewer new cars joining UK fleets, down 5.5% on August 2019.

Demand also fell across all segments except superminis, with the biggest declines in demand seen in the mini (-64.2%) and specialist sports (-41.9%) categories.

Zero emission-capable vehicles fared better as a result of new models coming to market, with sales of plug-in hybrids increasing by 221.1%, although they still only accounted for 1 in 30 sales.

Registrations of battery electric cars increased by 77.6% in the month, accounting for 6.4%. However, they make up just 4.9% of registrations year to date, up from 1.1% in the same period last year – clearly illustrating the scale of the challenge ahead to reach the government target for EVs to comprise 70% of new car sales by 2030.

The figures were released as the UK automotive industry calls for binding targets on charging infrastructure development and long-term commitments to incentivise the purchase of zero emission capable vehicles to accelerate demand.

In the past five years, the range of zero emission capable car models available in the UK has trebled to more than 80, with some 200 more in the pipeline over the coming years. For customer demand to keep pace, at least 1.7 million new on-street charging points will need to be built by 2030, along with a long-term commitment from government to provide incentives for EV purchases.

Overall, registrations remain down by 39.7% in the year to date, some 600,000 units behind this time in 2019, following coronavirus enforced lockdowns.

Mike Hawes, SMMT Chief Executive, said, “The decline is disappointing, following some brief optimism in July. However, given August is typically one the new car market’s quietest months, it’s important not to draw too many conclusions from these figures alone.

“With the all-important plate change month, September is likely to provide a better barometer. As the nation takes steps to return to normality, protecting consumer confidence will be critical to driving a recovery.”

The August decline came as no surprise to the National Franchised Dealers Association (NFDA) due to strong performances in previous years driven by pre-registration ahead of new emissions regulations that came into force in September 2018 and 2019.

Director Sue Robinson added, “Retailers remain optimistic, 86.5% of dealerships have now reopened and have been busy since. Most staff have come back to work and customer footfall levels, as well as online inquiries, are buoyant.

“We expect the movement away from public transport towards privately owned vehicles to continue to benefit the sales of new and used cars. Additionally, the increase in disposable income for a number of consumers who have not been on holiday and were able to save during the lockdown can fuel demand over the coming weeks.

“August is a small month in volume terms and it would be wrong to draw any major conclusions from these figures. Looking forward, NFDA expects a very strong September plate change month for new vehicle sales”.

Michael Woodward, UK Automotive Lead at Deloitte, said be believes that September, a key month for new car sales, will be a bumper month for the industry as consumers take advantage of enticing discounts to secure a new 70 plate.

He added: “However, according to our latest research, nearly half of consumers are planning to keep their current vehicle for longer than planned meaning that once pent up demand is met, sales may subsequently drop off.

“Demand over the course of the year will also likely be affected by consumers’ financial situations. Should unemployment rates continue to rise, new car sales could stall. However, with many consumers looking for a public transport alternative, demand for cheaper models could fuel the used car market.

“The auto industry typically works on a five to six month production planning cycle meaning that if September doesn’t herald an uptick in sales, more challenging decisions may need to be made for Spring 2021.

“Some manufacturers might predict sales returning to normal over the next six months, but the consensus view is likely to be less optimistic, potentially impacting planned production.

“Should factories continue to operate below capacity, the pandemic financial support from manufacturers that has been offered to dealerships to date will likely be reduced, or in some cases withdrawn. This could lead to further discounting to ensure new car stock is moved quickly from forecourt to consumer.

Karen Johnson, Head of Retail and Wholesale at Barclays Corporate Banking, said August’s drop was a “slight surprise” as vehicle registration figures have been steadily heating up for a number of months.

She added: “My conversations with dealers have been largely positive over recent weeks, with many optimistic about the months ahead. However the period before the September number plate change is typically quiet, and consumer appetite has not been enough to buck this trend post-lockdown.

“Looking ahead, dealers will be hopeful that a number of changes in the pattern of everyday life may lead to an increase in motor sales.

“A lot of buyers have more cash in their pockets for big ticket purchases following months of lockdown with lower expenditure. Many have also reviewed their household logistics, with nervousness of public transport and changing working patterns all leading people to rethink their vehicle needs.”

Leave A Comment