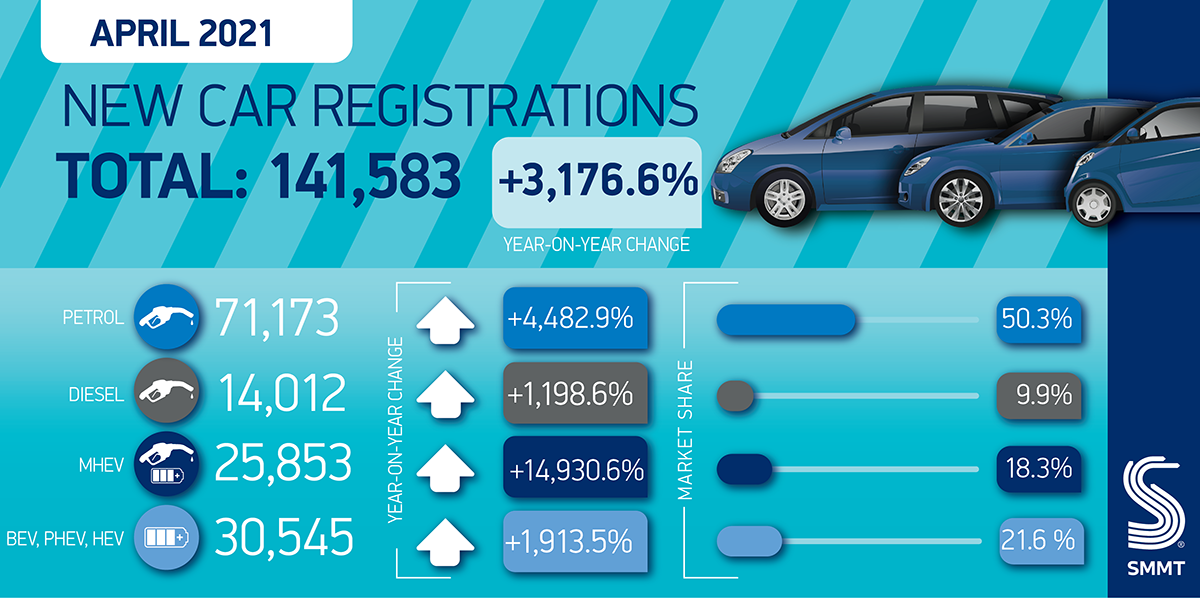

CAR showrooms reopening in April sparked an artificial 30-fold increase of new car registrations compared to the same month last year, but volumes still remained almost 13% lower than the 10-year average at just 141,583 new units.

The latest figures released by the Society of Motor Manufacturers and Traders (SMMT) showed that this year’s monthly total dwarfed that recorded in April 2020, when the first national lockdown effectively shut the country, and just 4,321 cars were registered.

Retail demand saw the most significant recovery, rising from just 871 registrations last April to 61,935. Click and collect supported the market for the first week and a half until dealerships could reopen on 12 April – a marked contrast from the same month last year, where Covid restrictions effectively prevented private purchases.

However, April 2021’s consumer registrations were still -14.5% down on the 10-year average.

Total plug-in vehicle market share broadly followed the trend seen in recent months, accounting for just over one in eight vehicles, or 13.2%. Unusually, plug-in hybrids (PHEVs), at 6.8% of the market, were more popular than battery electric vehicles (BEVs) at 6.5%, following cuts to the Plug-in Car Grant. Monthly BEV uptake was down compared with Q1 2021 overall, however, as they had been running at 7.5% of total registrations.

Overall registrations for 2021 now stand at 567,108 units, some -32.5% down on the average recorded over the past decade. However, the full impact of showrooms reopening has yet to be realised, given the delay between a customer initially visiting a dealership, deciding on a model and then taking delivery of that new vehicle is normally a number of weeks.

In light of the more upbeat economic outlook on the back of vaccine rollout and easing of the lockdown restrictions in line with government roadmap, SMMT has revised its forecasts upwards from 1.83 million – based on a snap poll in February – to around 1.86 million new cars to be registered by the end of the year, a 13.9% increase on 2020. However, this would still be some -20.2% down on the average of 2.33 million registrations a year recorded between 2010 and 2019. Demand is likely to be driven by a broad range of new models and powertrains, with confidence bolstered by the gradual reopening of the country.

BEVs are now expected to account for 8.9% of registrations by year-end – down from the 9.3% initially forecast in January, in light of March’s changes to the Plug-in Car Grant. With PHEVs anticipated to take a 6.3% market share, total plug-in vehicles should comprise 15.2% of all cars registered in 2021.

The National Franchised Dealer Association said it was encouraged to see sales of new cars bounce back in April, reflecting the significant pent-up demand as the lockdown was eased.

Chief Executive Sue Robinson, said: “Sales of plug-in vehicles continue their upward trend. With new models coming to the market and retailers working hard to inform their customers and instil ‘charge confidence’ as opposed to range anxiety, the sector is bound to perform well.

“April’s results are positive considering dealerships have been open for less than three weeks, with sales previously supported by click & collect; since reopening, customer footfall and volume of enquiries at dealerships have been strong and driving schools are seeing a major increase in young people booking driving lessons and tests.

“All of this leads us to believe that there is a very upbeat outlook ahead for the motor industry in the summer and retailers are looking forward to a further release of the pent-up demand accumulated over the past months”.

James Fairclough, Chief Executive of AA Cars said: “Comparing this April to last reveals little, other than just how hard the industry was hit at the start of the first lockdown – when dealers were only just exploring the click and collect and delivery options they successfully embraced later in the year.

“To get a better sense of the current health of the market, we need to compare it with pre-pandemic levels. Although this April’s figures still lag behind those of previous Aprils, sales are edging closer to pre-pandemic levels, and there are further reasons for optimism now forecourts have reopened for business.

“March was a successful month for a start, bolstered by new number plates, and the early evidence from the re-opening of retail and hospitality is that people are ready to spend money saved during successive lockdowns.

“It was always going to take some time for the industry to return to pre-pandemic levels, but as restrictions ease further and the vaccination roll-out reaches all adults, we may start to see spending pick up on big ticket items such as new cars.

“However, there is also evidence that some drivers are starting to reassess how they pay for their vehicles, as interest in cars available to lease with an AA Smart Lease grew by more than 40% between March and April. We expect that more drivers will move away from traditional car ownership in favour of leasing this year, to benefit from greater flexibility.”

.

Leave A Comment