For most people working in the trade, the competitive rivalry between Glass’s Guide and Cap has been a constant feature of the business scene for as long as they can remember. The debate about which price guide is more accurate, could be about to be shaken up by an analysis of the UK’s 100 top selling second hand cars which seems to suggest a clear difference between the two protagonists in the battle of the price guides.

To try and settle the argument, the team at Glass’s, who process over 5 million different vehicle price observations each year, looked at the prices that were actually paid at auction for the top selling 100 car models to go under the hammer in UK auctions between February and September 2013.

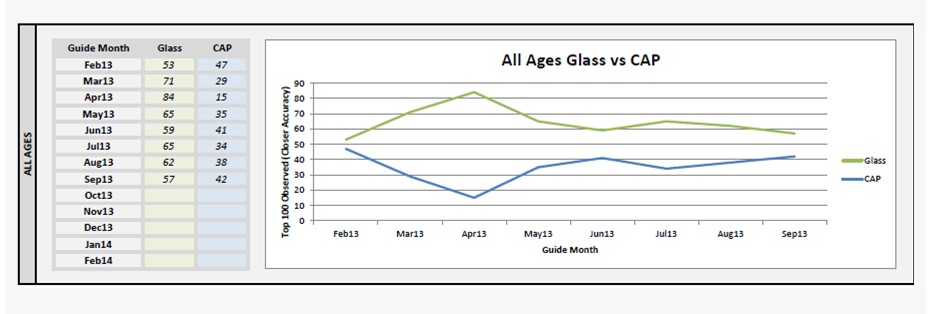

Pointing to the graph for 2013 values, Glass’s Managing Director Ian Tilbrook revealed the findings saying, “This is really a very important piece of information, this is showing that against our closest competitor, at this moment in time and over recent months we are showing more accurate comparisons than our competitor.”

Talking about how they did this, Richard Parkin, Glass’s Director of Valuations & Analysis said, “We get the paper guides from CAP and we go down the top 100 most traded vehicles at auction every month and then we try and re-create the values that were actually seen at auction with values from our own guide and CAP’s guide and we see on each of those observations who was closest.”

Parkin adds, “100 different cars is about 8,000 observations in total. It scores one or nil to us or CAP depending on who was closer in absolute terms. As we run down the list, it’s averaging about 60:40 in favour of us (Glass’s).”

Prior to joining Glass’s, Tilbrook was MD at car leasing giant ING and he can clearly see opportunities for the business in the fleet sector where rivals CAP have long held sway, saying, “The good news for us is there is an opportunity for us to challenge in the fleet and finance field and there is clearly an opportunity for us to work with the big leasing companies.”

Tilbrook explains how Glass’s have moved into that space by saying, “In the last couple of years we made an acquisition of an organisation in Finland called Grey Hen, which gives us a statistical analysis engine (SAE) that helps us create forecast values and used values”

Returning to the focus on the accuracy of Glass’s valuations, Parkin says of the new technology, “It gives us the ability to help industrialise the guide valuation process, it’s about the behaviour of the values and the relationships between them. It does a lot of that automatically and it underpins a more accurate approach.”

Leave A Comment